A Review Of How Will Filing Bankruptcy Affect My Small Business

But that's only one variable the trustee will consider. The subsequent is just as vital plus a little bit additional sophisticated.

In case you are Individually to blame for business-linked debts, those is usually considered as part of the Chapter thirteen bankruptcy. This suggests a sole proprietorship could also take advantage of a Chapter 13 filing.

But if the corporate can be an LLC or Company, you will not personal any business assets—you may very own shares or an interest in the company. That is what you'll exempt.

Chapter twelve from the bankruptcy code is incredibly particular, because it’s only an selection for loved ones farmers or family fishermen who want to set up a payment want to repay their existing debts above the next three to 5 years.

You shouldn't mail any delicate or confidential information and facts by This page. Any facts sent by way of this site won't generate a lawyer-consumer connection and might not be dealt with as privileged or private.

So for those who individual an attractive ongoing operation you can't safeguard (attempt a wildcard exemption), you might shed it in Chapter 7.

Some business homeowners are chargeable for the business's debts, and if you are a dependable party, it is possible to hope a creditor to report the debt in your credit rating report. You can identify your legal responsibility partially find more information by checking out the business framework employed when forming the business.

Composed by Brooke Kunz Brooke is usually a copywriter and artisan ice product fanatic dwelling in California's sunny Central Valley. She's happiest when mountaineering from the backcountry, baking a very advanced cake recipe, or examining an engrossing new memoir.

You are charged with individual responsibility webpage should you gather these taxes but fail to transmit them towards the taxing authority. This financial debt will affect your credit, especially if a tax lien is submitted basics from you and recorded in the public documents.

Chapter 7 is the only real method of business bankruptcy that is certainly legally accessible to all sorts of businesses. You don’t should fulfill any requirements to file.

The find out here data on this Web page is for common details applications only. Almost nothing on This page really should be taken as legal tips for virtually any personal circumstance or scenario. This facts is not intended to build, and receipt or viewing doesn't constitute, a legal professional-client connection.

This "loophole" allows the filer to wipe out qualifying personal debt in Chapter seven Even with earning a considerable wage. Check with having a proficient bankruptcy attorney seasoned in business bankruptcies.

We are seeking attorney matches in your town. You should tell us how they could get in contact for just a consultation. There was a difficulty Along with the submission. You should refresh the website page and check out again

Therefore you received’t browse this site have to worry about it becoming sold to address business debts. This exemption only relates to Major residences and not secondary residences that you may perhaps individual.

Edward Furlong Then & Now!

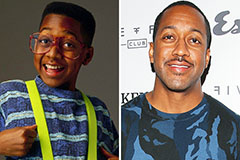

Edward Furlong Then & Now! Jaleel White Then & Now!

Jaleel White Then & Now! Jennifer Grey Then & Now!

Jennifer Grey Then & Now! Danielle Fishel Then & Now!

Danielle Fishel Then & Now! Katey Sagal Then & Now!

Katey Sagal Then & Now!